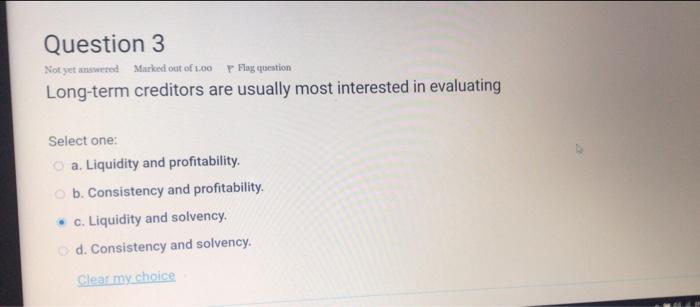

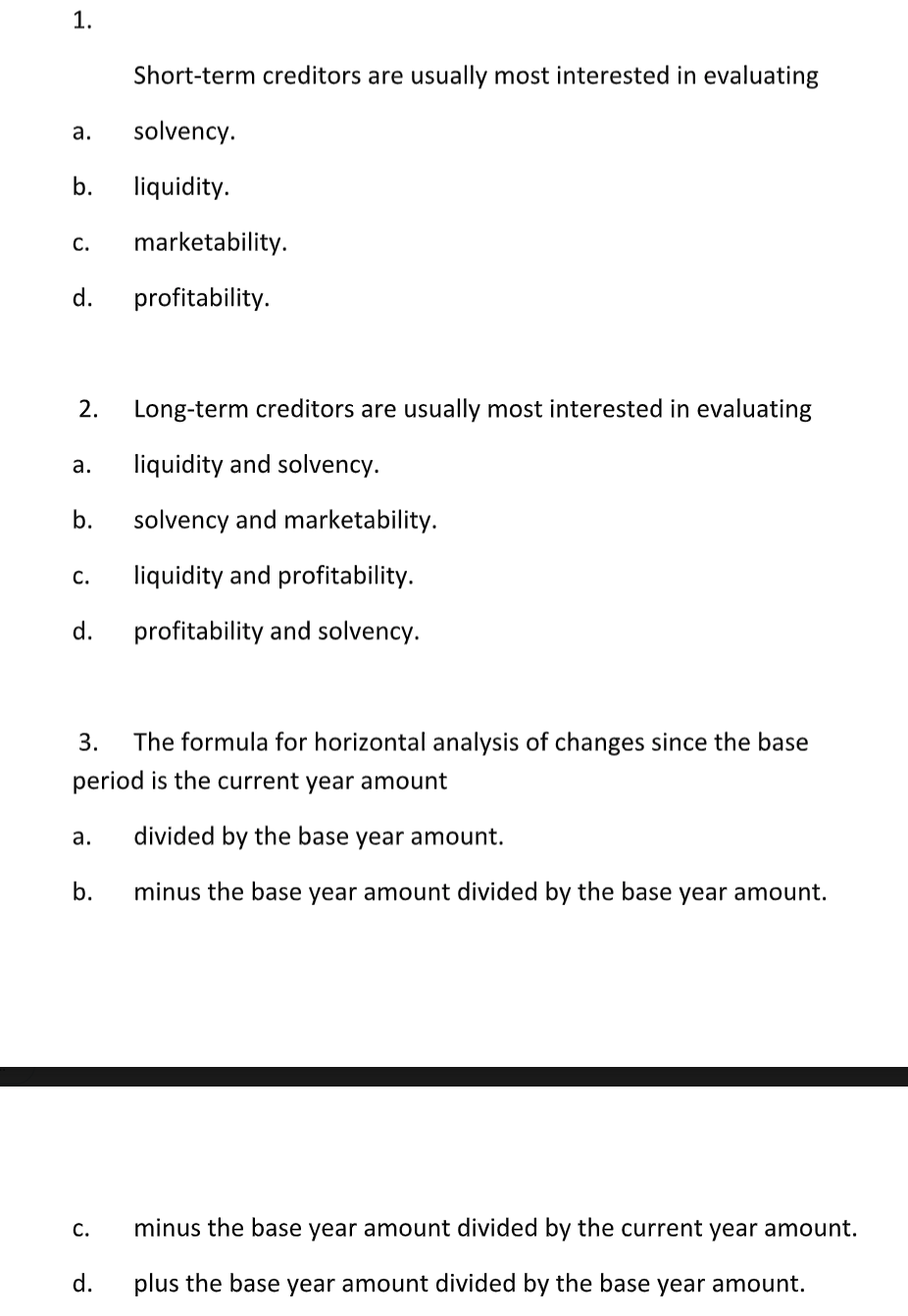

SOLVED: ralse 6.When a liquidity ratio is interesting to shor-term creditors, a market value measure i.e.PE ratio) is relevant to long-term creditors.(10points) a.True b.False 7.When a firm increases its debt-to-equity ratio. Other

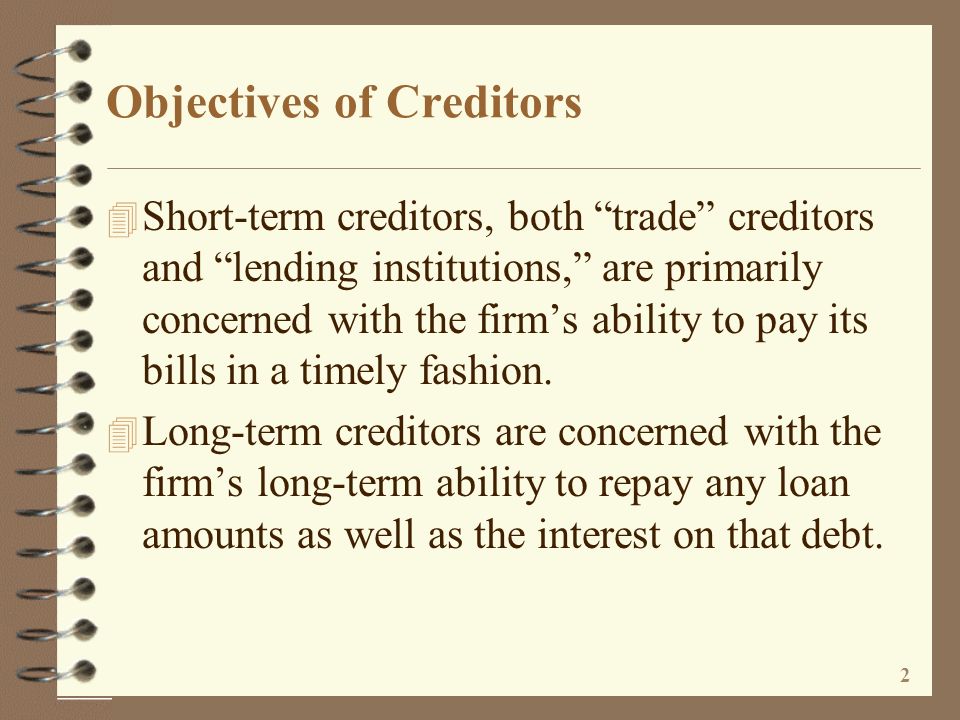

Ratio Analysis Ratio analysis is a particular type of financial statement analysis where the relationship between two or more items from the financial. - ppt video online download

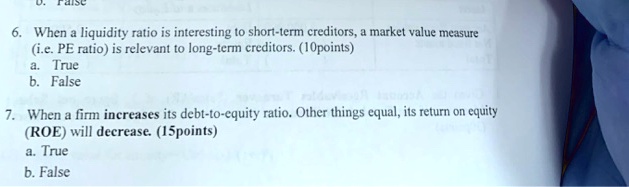

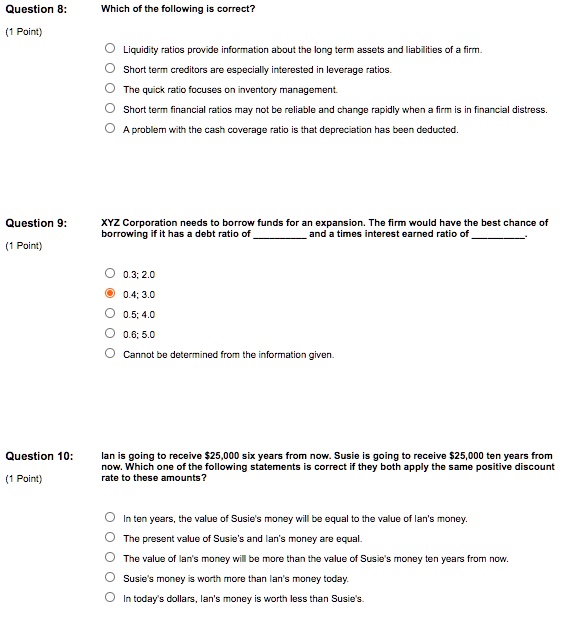

SOLVED: Question 8: Which of the following is correct? (1 Point) O Liquidity ratios provide information about the long term assets and liabilities of a firn. O Short term creditors are especially

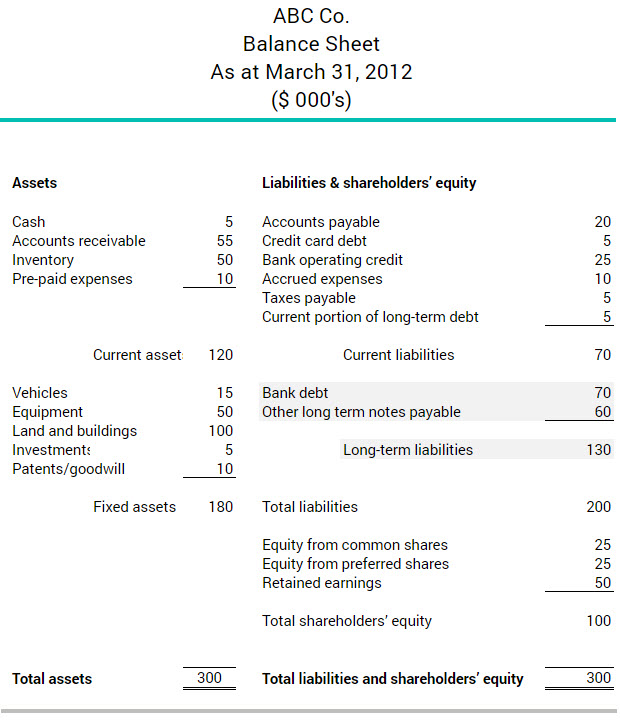

Q1. Evaluate the financial performance (from Equity shareholders perspective) and short-term & - Brainly.in

:max_bytes(150000):strip_icc()/Currentportionlongtermdebt_final-f0e9680318e3457b98d7ecfeb0f761a4.png)

:max_bytes(150000):strip_icc()/preferred-creditor-Final-3521f5da61044636ba048cacea1db2ef.png)